Arvest CD Rates

The recognition of Arvest CD banking is exceptionally important due to its long-term investment plans along with the required APY circumstances.

It offers credible enhancement and authorization for the cash deposit. The major attraction for Arvest CD Rates is the offers that are provided to the consumers for rich enhancement.

Arvest CD Rates Offers

The significant offer approaches by Arvest Bank are given below;

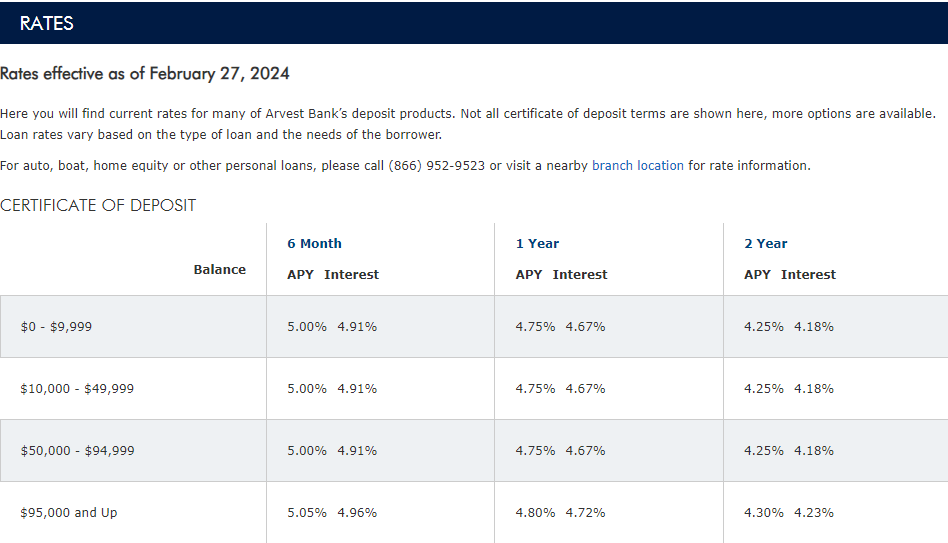

6-Month Term

Key Features

- Balance $0 – $9,999:

- APY: 5.00%

- Interest: 4.91%

- Balance $10,000 – $49,999:

- APY: 5.00%

- Interest: 4.91%

- Balance $50,000 – $94,999:

- APY: 5.00%

- Interest: 4.91%

- Balance $95,000 and Up:

- APY: 5.05%

- Interest: 4.96%

Considerations

- This offer is suitable for individuals who want a slightly higher interest rate than a regular savings account but need access to their funds within a relatively short period.

Pros & Cons

| Pros | Cons |

| It is suitable for emergency funds | Rates may decline deliberately |

| Highly flexible plans | |

| Competitive investment plan |

1-Year Term

Key Features

- Balance $0 – $9,999:

- APY: 4.75%

- Interest: 4.67%

- Balance $10,000 – $49,999:

- APY: 4.75%

- Interest: 4.67%

- Balance $50,000 – $94,999:

- APY: 4.75%

- Interest: 4.67%

- Balance $95,000 and Up:

- APY: 4.80%

- Interest: 4.72%

Considerations

- It is ideal for those who want a slightly higher return on their investment but are still looking for relatively short-term commitment and access to funds shortly.

Pros & Cons

| Pros | Cons |

| Shorter Commitment investment plans | Interest Rate Implies |

2-Year Term

Key Features

- Balance $0 – $9,999:

- APY: 4.25%

- Interest: 4.18%

- Balance $10,000 – $49,999:

- APY: 4.25%

- Interest: 4.18%

- Balance $50,000 – $94,999:

- APY: 4.25%

- Interest: 4.18%

- Balance $95,000 and Up:

- APY: 4.30%

- Interest: 4.23%

Considerations

- For all those individuals who are willing to lock in their funds for a more extended period in exchange for a higher interest rate.

- It provides a balance between earning a competitive rate and maintaining some liquidity.

Pros & Cons

| Pros | Cons |

| Higher Interest Rates | Less Liquidity |

| Predictable Returns | Inflexibility |

| Lower Risk |

CD Rates Comparison Table

At Arvest Bank, the APY top rates differ for each client depending on their balance. Please see the chart below to see where you fall:

Are Arvest Bank CD Rates Competitive?

Arvest Bank CD rates are generally competitive within the market, offering a range of terms and interest rates to suit different investor preferences.

The bank provides various CD options with terms ranging from a few months to several years, allowing customers to choose the one that aligns with their financial goals. While competitiveness can vary depending on market conditions, Arvest Bank strives to provide customers with attractive CD rates to help them grow their savings.

How do Arvest Bank CD Rates compare?

When comparing Arvest Bank CD rates to those offered by other financial institutions, it’s essential to consider the specific terms and durations. Arvest Bank’s rates are often competitive in the regions it serves, including Arkansas, Kansas, Missouri, and Oklahoma.

However, individual preferences, market conditions, and the current interest rate environment should also be taken into account when assessing how Arvest Bank CD rates compare.

Potential customers may find it beneficial to explore rates offered by other banks and credit unions to ensure they secure the most favorable terms for their investment needs.

Overview of Arvest Bank

Arvest Bank’s story begins back in 1961. In Northwest Arkansas, The Bank of Bentonville, which has $3.5 million in deposits, was purchased in 1961. Then in 1963, another bank was bought in the nearby town of Pea Ridge. Then in 1975, another bank was purchased in the neighboring town of Rogers- each of these banks, for almost a decade, were locally managed, and thus, the banking network is now known as Arvest.

By 2006, Arvest Bank was operating more than 200 branches. Arvest Bank has grown its assets to more than $7 billion. Since that time, Arvest further expanded to Springfield, MO, and the Greater Kansas markets. Recently though, Arvest acquired Bear State Bank.

Today, Arvest has more than 100 locations that are now a part of the 14 locally managed banks in more than 135 communities. If that was not impressive enough, Arvest’s total assets now exceed $20 billion. Arvest is the largest bank in Arkansas in terms of deposit market share.

Arvest does its best to provide for its community as well as for its members. Please check out their website to find an Arvest location near you. Please note that promotions or deals may vary depending on the location/branch near you. For hours and locations of their branches, please check their website. Please note hours do not include Holidays.

Locations of Arvest Banking

Arvest Bank currently does not have any locations in California. They do, however, have locations in Arkansas, Kansas, Missouri, and Oklahoma.

Availability

You must be a member of the Arvest Bank to open a CD. This means that you will need to open a checking or savings account. Ensure that all of your papers are available to make the process as simple as possible.

If you are interested in Arvest’s other locations, you may find them on their respective website or simply click here.

FAQs

Arvest Bank primarily operates in the central United States and does not have an extensive international presence. Its focus has historically been on serving communities in Arkansas, Kansas, Missouri, and Oklahoma.

Another name associated with Arvest is “Arvest Wealth Management.” However, it’s important to note that Arvest Wealth Management is a division or segment of the larger Arvest Bank organization, providing wealth management services to clients. Arvest Bank and Arvest Wealth Management are affiliated entities within the Arvest brand.

For the cash flow, Arvest Bank employs a combination of technology, risk management, and liquidity management strategies to ensure the efficient handling of cash flows.

Yes, Arvest Bank is considered a community-based financial institution. It emphasizes a community-oriented approach and is known for its commitment to serving the financial needs of the local communities in which it operates. This may involve supporting local businesses, participating in community events, and offering a range of banking services tailored to the needs of the community.

The process of managing deposit checks in Arvest Bank is likely to involve standard banking procedures. Customers can typically deposit checks through various channels, including in-branch, ATMs, and mobile banking applications.